When it comes to investing, we often hear the age-old advice: “Cash is king.” But is it really? With interest rates expected to decrease, holding too much cash in your portfolio could potentially prevent you from maximising your wealth.

The Bank of England (BoE) has raised interest rates in recent years, from a low of 0.1% in December 2021 to reach highs of 5.25% by July 2024. As at January 2025, the UK Bank Base Rate remains at 4.75%. This in turn meant that cash deposits have become more attractive with higher interest rates available.

Cash: a reliable old friend?

Aside from making the most of interest rate hikes, there are many reasons why people prefer to hold cash – it’s easily accessible and provides immediate spending power; it can also provide a degree of psychological comfort and reduce personal anxiety about life’s financial uncertainties. These factors combine to make holding cash a popular choice for many, despite the potential drawbacks of not potentially earning higher returns from other savings and investment options.

However as interest rates fall, this will reduce your return on cash where the rate is variable. There is also the risk of missed opportunities from investing in the stock market – this was highlighted in 2023 by the much stronger performance from investments following a turbulent 2022.

Can holding cash damage your wealth?

Inflation is the ultimate enemy of cash. Like a silent thief, it slowly and quietly erodes the value of your cash over time, which means that cash can deliver significant losses in real terms over longer periods of time.

Take for example the cost of a holiday. Using the Bank of England’s inflation calculator, a holiday costing £1,000 in 2003 would have cost approximately £1,305 in 2013, £1,750 in 2023, and around £1,820 in 2024. This means that over 21 years, the cost of that holiday increased by 82%, and even in the past year, it increased by 4%. This illustrates the ongoing impact of inflation on the things you buy.

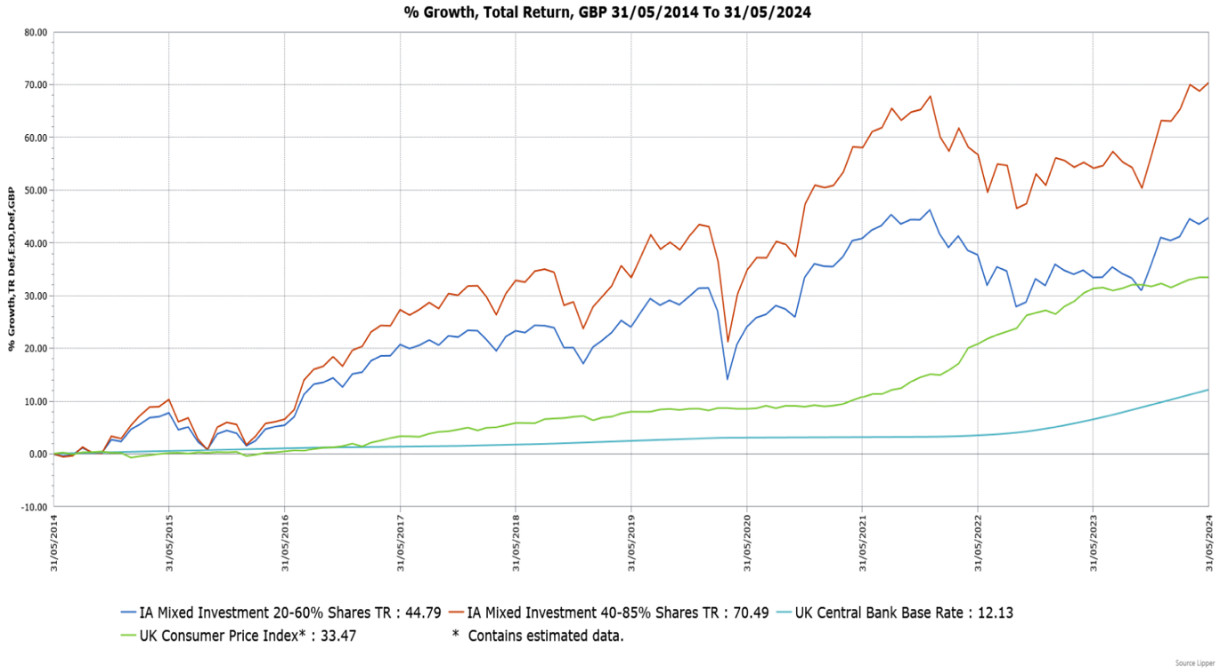

The graph compares the return on cash based on the UK Bank Base Rate, inflation (the Consumer Price Index), and the average performance of different generally medium risk investments over the past ten years. While the average performance of investments fluctuates more than cash, it also shows stronger long-term performance. What’s more, the return on cash has failed to beat inflation over this period. This shows that, over the longer term, cash can produce losses in real terms, whereas other investments have historically provided returns that outpace inflation.

Whilst historic market performance is no indicator of future performance and the value of investments can go down as well as up, moving surplus cash into other investments can help to preserve and grow your purchasing power and wealth over the longer term.

Historically, investing has outperformed cash over longer periods, even with occasional volatility. It is crucial to take a long-term perspective during difficult periods when markets are suffering losses and to not act too quickly. By selling investments too early, this will likely mean missing out on any recovery. Historic data suggests that while most investments may face some short-term volatility, they generally trend upwards over the longer term – although this cannot be guaranteed.

It’s a balancing act

We would always advocate holding some short-term ‘emergency cash’, with easy access to your money for any planned expenditure within the next two to three years, as well as to cover any unexpected financial emergencies.

However, over the longer-term, you should consider whether holding surplus cash is the right decision, even during the periods of higher interest rates. We would still expect inflation over time to reduce the buying power of cash and cash-based investments.

If you are happy to accept some risk and that your investments may go down as well as up, we believe that over the longer-term (more than five years), investments in a diverse portfolio of multi-asset funds can potentially offer stronger returns.

At the end of the day, figuring out how much cash you need on-hand versus how much to save in long-term investments is a personal decision and entirely based on your own circumstances. We would always suggest taking financial advice to help you decide the best options for you.

Speak to us today

If you’d like some help with your financial planning or discuss the investments you hold with Aegon Financial Planning, please contact your Aegon Financial Planning Manager, call us on 0800 464 3079*, or request an appointment using the button below.

Call charges vary. Lines are open Monday to Friday between 8.30am and 5.30pm. All calls are recorded for business purposes. Afp092. Exp 01/26

Market Commentary – Quarter 1, 2025