Introduction

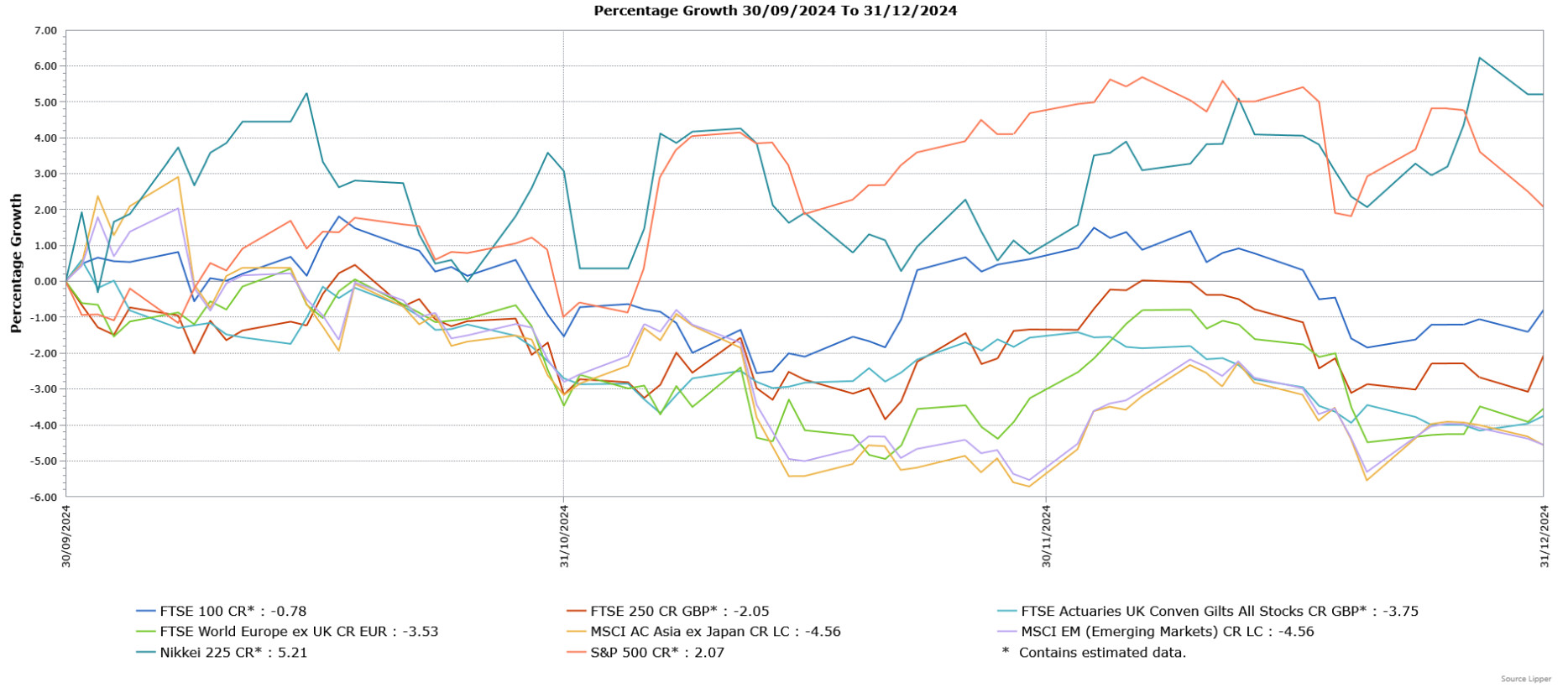

The fourth quarter of last year saw mixed performance from global equity markets, with sentiment dominated by the US Presidential election. Donald Trump’s clear victory as well as the accompanying “Red Sweep” that saw the Republicans take full control of congress, provided support to US equities, amid expectations that the President’s policy measures would increase growth, lower taxes and reduce regulation. However, concerns over tariffs weighed on other regional markets.

The fourth quarter saw further interest rate cuts, with the US Federal Reserve announcing 0.25% reductions in November and December. However, at its December meeting the Federal Reserve reduced the number of interest rate cuts it expects to announce in 2025, causing markets to fall. The European Central Bank delivered two further rate cuts, each for 0.25%, whilst indicating further reductions to come in 2025. The UK faced concerns around the new government’s fiscal policies announced in its Autumn Budget, whilst the Bank of England, having announced a 0.25% interest rate cut in November, said stubborn inflationary pressures would prevent them from reducing rates quickly in 2025.

Market Performance

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK Equities

UK equities declined in the fourth quarter, with investor sentiment negatively affected by growing concerns over the UK economic outlook. The increase in long-term bond yields also weighed, with the rise picking-up pace after the announcement of the government’s fiscal policies in the Autumn Budget. In addition, there were early signs that the cost increases unveiled in the Budget could weigh on the jobs market, whilst other data showed the economy had contracted in both September and October, whilst the third quarter reading was revised lower from 0.1% to 0%. Against this backdrop, the more domestically focused mid-cap FTSE 250 (the 250 largest companies outside of the FTSE 100) suffered a bigger loss than the FTSE 100.

Global Equities

The US S&P 500 (which measures 500 of the largest US companies) recorded a gain in the fourth quarter, boosted by expectations of growth-friendly policies under the incoming new President. However, US equities did suffer a sell-off at the end of the year after the Federal Reserve stated it was expecting less interest rate cuts in 2025 than previously projected. European markets, as demonstrated by the FTSE World Europe ex UK Index (which measures large and mid cap stocks across Europe), declined amid political instability in France and Germany, concerns over recession and the possibility of trade wars. The Japanese Nikkei 225 Index (a measure of Japan’s top 225 companies) outperformed as its posted a strong positive return as weakness in the yen supported the earnings outlook for large-cap exporters.

Asia and Global Emerging Markets Equities

Asian markets suffered a sharp fall, as shown by the performance of the broad MSCI Asia ex Japan Index (which captures the performance of over 1,000 companies across Asia), driven by investor concerns over potential tariffs following the re-election of Donald Trump. In particular, China and Hong Kong suffered declines due to the increased tensions over trade and technology, with Donald Trump having suggested imposing tariffs of 60% in Chinese goods. Most regional indices saw losses, with Singapore outperforming on the back its political stability and relative neutrality. Global Emerging Markets, as demonstrated by the broad MSCI Emerging Markets Index (which covers over 1,200 stocks from across 24 emerging markets countries), also saw a similarly sharp decline amid the threat of trade wars.

Fixed Income

There was a sell-off in fixed income markets, as shown by the performance of UK gilts (FTSE Actuaries UK Conventional Gilts Index). The losses were driven by concerns of inflationary fiscal policies, notably in the UK and the US, as well as central banks suggesting a more gradual pace of interest rate cuts in 2025. In the UK, the Budget led to losses in gilts amid worries over increased borrowing, whilst the Bank of England highlighted concerns over sticky inflation and wage growth.

Afp093 exp01/26

Home > Market Commentary – Quarter 4, 2024

Market Commentary – Quarter 4, 2024

Introduction

The fourth quarter of last year saw mixed performance from global equity markets, with sentiment dominated by the US Presidential election. Donald Trump’s clear victory as well as the accompanying “Red Sweep” that saw the Republicans take full control of congress, provided support to US equities, amid expectations that the President’s policy measures would increase growth, lower taxes and reduce regulation. However, concerns over tariffs weighed on other regional markets.

The fourth quarter saw further interest rate cuts, with the US Federal Reserve announcing 0.25% reductions in November and December. However, at its December meeting the Federal Reserve reduced the number of interest rate cuts it expects to announce in 2025, causing markets to fall. The European Central Bank delivered two further rate cuts, each for 0.25%, whilst indicating further reductions to come in 2025. The UK faced concerns around the new government’s fiscal policies announced in its Autumn Budget, whilst the Bank of England, having announced a 0.25% interest rate cut in November, said stubborn inflationary pressures would prevent them from reducing rates quickly in 2025.

Market Performance

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK Equities

UK equities declined in the fourth quarter, with investor sentiment negatively affected by growing concerns over the UK economic outlook. The increase in long-term bond yields also weighed, with the rise picking-up pace after the announcement of the government’s fiscal policies in the Autumn Budget. In addition, there were early signs that the cost increases unveiled in the Budget could weigh on the jobs market, whilst other data showed the economy had contracted in both September and October, whilst the third quarter reading was revised lower from 0.1% to 0%. Against this backdrop, the more domestically focused mid-cap FTSE 250 (the 250 largest companies outside of the FTSE 100) suffered a bigger loss than the FTSE 100.

Global Equities

The US S&P 500 (which measures 500 of the largest US companies) recorded a gain in the fourth quarter, boosted by expectations of growth-friendly policies under the incoming new President. However, US equities did suffer a sell-off at the end of the year after the Federal Reserve stated it was expecting less interest rate cuts in 2025 than previously projected. European markets, as demonstrated by the FTSE World Europe ex UK Index (which measures large and mid cap stocks across Europe), declined amid political instability in France and Germany, concerns over recession and the possibility of trade wars. The Japanese Nikkei 225 Index (a measure of Japan’s top 225 companies) outperformed as its posted a strong positive return as weakness in the yen supported the earnings outlook for large-cap exporters.

Asia and Global Emerging Markets Equities

Asian markets suffered a sharp fall, as shown by the performance of the broad MSCI Asia ex Japan Index (which captures the performance of over 1,000 companies across Asia), driven by investor concerns over potential tariffs following the re-election of Donald Trump. In particular, China and Hong Kong suffered declines due to the increased tensions over trade and technology, with Donald Trump having suggested imposing tariffs of 60% in Chinese goods. Most regional indices saw losses, with Singapore outperforming on the back its political stability and relative neutrality. Global Emerging Markets, as demonstrated by the broad MSCI Emerging Markets Index (which covers over 1,200 stocks from across 24 emerging markets countries), also saw a similarly sharp decline amid the threat of trade wars.

Fixed Income

There was a sell-off in fixed income markets, as shown by the performance of UK gilts (FTSE Actuaries UK Conventional Gilts Index). The losses were driven by concerns of inflationary fiscal policies, notably in the UK and the US, as well as central banks suggesting a more gradual pace of interest rate cuts in 2025. In the UK, the Budget led to losses in gilts amid worries over increased borrowing, whilst the Bank of England highlighted concerns over sticky inflation and wage growth.

Afp093 exp01/26

Related News & Insights

Planning for a secure retirement: Insights and Tips

Make the most of your new tax year allowances

Market volatility – how long-term financial planning helps

Market Commentary – Quarter 1, 2025

Is cash really still king?

Ways to maximise your ISA savings before tax year end

Market Commentary – Quarter 3, 2024

October Budget – reduce the impact of any tax increase